TaxSlayer Promo Code: 20% Off + Cash Back - Dec 2025

Let's be honest, tax season isn't exactly a holiday. But for savvy filers, getting a head start in December is the key to a stress-free April and a healthier wallet. If you're looking for a powerful, user-friendly tax software that won't break the bank, you're probably already a fan of TaxSlayer. It's built its reputation on providing incredible value, making it a go-to choice for millions who want to file accurately without paying a premium.

When the hunt for savings begins, many people instinctively start searching for TurboTax promo codes, hoping to chip away at the cost of one of the biggest names in the industry. But smart shoppers know that the best value often lies with a competitor that prioritizes affordability from the start. We've created this guide to show you every possible way to get the absolute best price on TaxSlayer, from little-known strategies and special discounts to understanding their free filing options.

Top TaxSlayer Promo Codes

TaxSlayer Federal Filing Offer

Free for militaryActive duty military can file a federal return for free. It covers all tax situations with no restrictions. State is an additional fee.

TaxSlayer Self-Employed Tax Software

$53The TaxSlayer Self-Employed Tax Software option is $53. This software caters to 1099 filers including those with W-2 income as well. State is an additional fee.

TaxSlayer Premium Tax Software

$43Get the TaxSlayer Premium Tax Software for $43. Access a full range of resources for fast, confident filing. State is an additional fee.

TaxSlayer Classic Tax Software

$23Get the TaxSlayer Classic Tax Software for $23. The Classic option is the best value. Unlike most other filling options, you can choose to upgrade for extra support vs. extra forms. State is an additional fee.

TaxSlayer Simply Free Tax Software

FreeGet the TaxSlayer Simply Free Tax Software for free. State is included. Simply Free includes one free federal return and is available to a limited number of taxpayers with age, income, credit, and deduction restrictions.

Expired TaxSlayer Promo Codes

TaxSlayer Federal Tax Filing

20% offCoupon code "SAVE20" gets this discount on the tree paid tiers — it drops the Classic option to $22.36 ($6 off), Premium to $39.96 ($10 off), and Self-Employed to $47.96 ($12 off).

What TaxSlayer Promo Codes Are Available This December?

While December is a bit like the quiet before the storm for tax software deals, it's the perfect time to get your strategy in place. TaxSlayer tends to reward early birds and loyal customers with exclusive offers rather than flooding the internet with generic codes. Their best discounts are often personalized and sent directly to users, so the key to saving isn't about finding a code—it's about knowing where to look and how to get on the right list.

Your Game Plan for Finding Promo Codes and Discounts

Think of this as your treasure map for TaxSlayer savings. By using these methods, you'll ensure you're in the best position to snag a deal as soon as it drops, especially as we head into the new year.

- Become an Email Insider: This is, without a doubt, the number one way to get a TaxSlayer promo code. Create a free account on their website and make sure you're opted-in to receive their marketing emails. This is how they send out their best offers, including early-bird specials for new users and loyalty discounts for returning customers. Pro Tip: Be sure to check your spam or promotions folder, as these valuable emails can sometimes get lost in the shuffle.

- Check the Official Source: TaxSlayer maintains a promotions page right on their website. While it's most active during peak tax season, it's always worth a quick look for any public-facing deals, which often include discounts of up to 20% off federal filing.

- Look for Partner Offers: Keep an eye on financial websites and major coupon aggregators like Groupon. These sites sometimes have exclusive or semi-exclusive codes for their readers. For example, NerdWallet has previously offered codes like "NERD20" that gave users 20% off their federal filing.

Free Filing and Special Offers

Beyond traditional promo codes, TaxSlayer has some fantastic built-in ways to save. These programs offer significant value and don't require you to hunt down a code at all.

- The Military Discount: Active-duty military members can file a federal tax return for $0 using the TaxSlayer Military program. This isn't a scaled-down version; it's their full-featured Classic edition that covers all tax situations and guarantees your maximum refund. No code is needed for this fantastic offer.

- The Simply Free Edition: Before you even think about paying, see if you qualify to file for free. TaxSlayer's Simply Free edition is perfect for those with simple tax returns and includes both a federal and one state filing at no cost. You generally qualify if your income is under $100,000, you don't have dependents, and you take the standard deduction. If your situation gets more complex, TaxSlayer seamlessly moves your data to a paid plan where you can then apply a promo code.

Even though the best percentage-off codes tend to roll out in January, using these strategies now ensures you're ready to pounce on the best deals. At DealNews, we keep a constant watch on these offers, so you can be confident you're always getting the best price on your tax software.

How to Redeem a TaxSlayer Promo Code

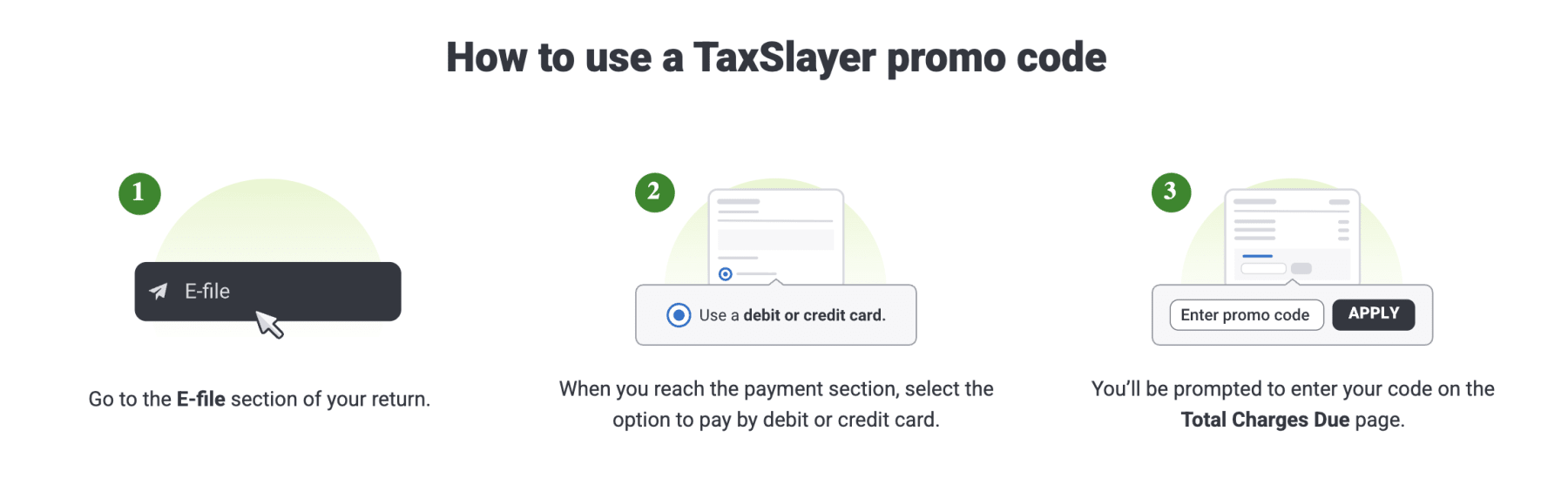

Once you've found a great promo code, TaxSlayer makes it incredibly simple to apply it. The option to add a code appears at the very end of the process, right when you're ready to pay and file. This straightforward system ensures you're not distracted by coupons while you're focused on entering your tax information correctly.

Here's a simple step-by-step guide to applying your discount:

- Create Your Account: Whichever plan you choose, you can get started for free. Get started by entering your email address and creating a username and password.

- Complete Your Tax Return: First, work your way through the TaxSlayer software and enter all of your income, deductions, and credit information.

- Proceed to the E-file Section: Once your return is complete and you're ready to submit it to the IRS, navigate to the e-file or payment section.

- Select Your Payment Method: To pay any filing fees, choose the option to pay with a debit or credit card.

- Find the Promo Code Box: On the payment or "Total Charges Due" screen, look for a field labeled "Have a Promo Code?" or something similar. Carefully type or paste your promo code into the box. Codes can be case-sensitive, so it's best to copy and paste directly if you can. Click the "Apply" button or the equivalent next to the code box.

- Verify the Savings: The page should refresh, and you'll see the discount reflected in your new, lower total.

Just like that, you've locked in your savings. It's always a good idea to give the final total a quick glance before you submit your payment, just to be sure everything looks right.

Key Things to Know About TaxSlayer Savings

Navigating the world of TaxSlayer discounts is pretty straightforward once you understand how they approach their promotions. Unlike retailers who have coupons available year-round, TaxSlayer's deals are more seasonal and targeted. Here are the answers to the most common questions to help you become an expert on saving.

How Do TaxSlayer Promo Codes Stack Up With Competitors?

When you're looking for the right tax software, it's smart to see how the competition compares, especially on price and features. TaxSlayer holds a strong position by offering comprehensive filing options at a price point that's tough to beat. While some competitors might have different bells and whistles, TaxSlayer focuses on providing everything you need to file accurately and maximize your refund for less.

|

Competitor |

Free Federal Filing? |

Prices (Federal) |

State Filing Fee |

Best For |

|---|---|---|---|---|

|

TaxSlayer |

Yes (Simple Returns) |

$25 - $53 |

~$40 |

Filers seeking the best overall value |

|

TurboTax |

Yes (Simple Returns) |

$69 - $129+ |

~$64 |

Beginners who want max hand-holding |

|

H&R Block |

Yes (Simple Returns) |

$55 - $115+ |

~$55 |

Online software with in-person support |

|

FreeTaxUSA |

Yes (All Returns) |

$0 (Deluxe is ~$8) |

~$15 |

DIY, budget, straightforward returns |

|

TaxAct |

Yes (Simple Returns) |

$50 - $65+ |

~$45 - $55 |

Solid alternative to the premium brands |

While industry giants like TurboTax and H&R Block offer very guided experiences, that premium service comes with a premium price tag that can easily be double or triple what you'd pay at TaxSlayer. Even after searching for the latest TurboTax promo codes and coupons for tax software, the final cost for a return with deductions and investments can be steep.

Similarly, while the option for in-person help from H&R Block is a valuable safety net, their online pricing is often higher, though it's always wise to check for any available H&R Block deals on tax products to compare the final cost. TaxSlayer provides a similar level of accuracy and form availability for a fraction of the price.

On the other end of the spectrum is FreeTaxUSA, which uses a different pricing model entirely by offering free federal filing for all tax situations and charging a small, flat fee for state returns. This is an excellent choice for filers with complex federal taxes but simple state needs, though it's worth checking for FreeTaxUSA savings on tax filing on their deluxe features to get the full picture.

A more direct rival, TaxAct, often appeals to the same cost-conscious filers as TaxSlayer, offering a reliable product at competitive rates. Their prices can sometimes be slightly higher than TaxSlayer's for comparable tiers, making it important to look for TaxAct discounts for their tax software before making a final decision. Ultimately, TaxSlayer consistently finds the sweet spot, delivering the perfect balance of comprehensive features, user-friendly design, and outstanding affordability.

What Does TaxSlayer Cost Before Promotions Are Applied?

TaxSlayer has built its brand on being one of the most affordable and high-value players in the tax software industry. Their pricing strategy is straightforward and refreshingly transparent: you pay for the level of support and features you need, not for every single form you have to add. This approach positions them as a formidable, budget-friendly alternative to more expensive competitors, ensuring you can file even a complex return without the fear of a massive bill at the end.

Here's a quick breakdown of their main packages for the 2025 tax season:

|

Package |

Price (Federal) |

Key Features |

Best For |

|---|---|---|---|

|

Simply Free |

$0 |

Basic 1040 return, W-2 income, standard deduction |

Very simple tax situations |

|

Classic |

$22.99 |

All IRS forms, credits, and deductions |

The vast majority of filers |

|

Premium |

$42.99 |

Priority support, live chat, and access to a tax pro |

Extra peace of mind |

|

Self-Employed |

$52.99 |

Specialized guidance for 1099 and Schedule C income |

Small business owners |

One of the most important things to remember is that these prices are for your federal return. Filing a state return typically incurs an additional fee, which is standard across the industry. Even with the added cost of a state return, TaxSlayer's all-in price consistently comes in lower than many of its big-name rivals, solidifying its reputation as the best value for your maximum refund.

What if I'm a Returning User?

This is one of the most common questions, and the answer is great news for loyal customers. While TaxSlayer doesn't typically offer a public-facing "existing user" promo code, they prioritize rewarding their returning filers. The best way to get a discount is by staying subscribed to their email list. They frequently send out personalized "welcome back" offers with unique codes or links that apply a discount directly to your account. So, if you've filed with them before, keep a close eye on your inbox as tax season approaches.

Are There Promo Codes for the Self-Employed?

Yes, you can absolutely find discounts for the TaxSlayer Self-Employed package. Most of the general, percentage-based promo codes (like a 20% or 25% off offer) are applicable to all of their paid federal filing products, including the Self-Employed version. Occasionally, TaxSlayer will release promotions specifically aimed at freelancers, contractors, and side-hustlers, so it's always worth checking for codes that apply to your specific filing needs.

Does TaxSlayer Offer a Military Discount?

Absolutely, and it's one of the best available. Active-duty military members can file their federal tax return for free using TaxSlayer Classic, which covers all tax situations. No promo code is necessary; the discount is applied through status verification.

What Have TaxSlayer Discounts Looked Like in the Past?

Historically, TaxSlayer has offered a range of discounts, often between 15% and 35% off their federal e-file products. On rare occasions, like during Black Friday sales, discounts have gone as high as 40% or even 50% off. The most common offers are typically in the 20-25% off range.

Can I Use Multiple Promo Codes on a Single Return?

No, TaxSlayer's policy allows for only one promo code to be used per tax return. Their system will not let you "stack" discounts. If you try to enter a new code, it will simply replace the previous one you entered.

Can I Use a TaxSlayer Promo Code for an Amended Return?

Typically, no. Most TaxSlayer promo codes are valid only for your initial federal tax return for the current tax year. They generally do not apply to amended returns (Form 1040-X) unless the promotion's terms specifically state otherwise.

Which TaxSlayer Filing Option Should I Choose?

It depends entirely on your tax situation. If you have a very simple return, start with Simply Free. For most people with deductions, credits, or investments, TaxSlayer Classic is the best value. If you want extra support and live chat, choose Premium. And if you're a freelancer or have 1099 income, Self-Employed is designed just for you.

What Guarantees Does TaxSlayer Offer?

TaxSlayer offers two key guarantees for your peace of mind. Their 100% Accuracy Guarantee means they will reimburse you for any federal or state penalties and interest charges caused by a calculation error in their software. They also offer a Maximum Refund Guarantee, promising that if you get a bigger refund with another tax prep software, they'll refund the purchase price you paid.

Troubleshooting TaxSlayer Promotions

It can be frustrating when a promo code doesn't work as expected. Usually, there's a simple explanation, and a quick check can solve the problem. Before you get discouraged, here are the answers to common issues that might pop up when you're trying to save.

What Should I Do if My Promo Code Isn't Working?

First, double-check that you've entered the code exactly as it appears, as they can be case-sensitive. Next, check the offer's terms and conditions. The most common reasons a code fails are that it has expired, it's for new customers only and you're a returning user, or it doesn't apply to the specific product you've chosen.

Can I Change a Promo Code I Already Applied?

Yes, you can. If you've entered a promo code but find a better one before you pay, you can swap it out. On the payment summary screen, there should be an option like "Have a different promo code?" that allows you to enter a new one. The system will then replace the old discount with the new one.

Why Is My Code Showing as "Invalid"?

An "invalid" error message usually means one of two things: either the code was typed incorrectly, or the code itself is not a legitimate, active TaxSlayer promotion. TaxSlayer recommends using codes you receive directly from them via email or from their official website to ensure validity. Codes from unverified third-party sites are more likely to be expired or fake.

I Used the IRS Free File Program, Can I Add a Promo Code?

No. The IRS Free File program offered through TaxSlayer is already a completely free service for those who qualify based on AGI and other factors. Because the product is already free, there is no cost to discount, so promo codes cannot be applied. If your tax situation changes and you no longer qualify for Free File, you'll be moved to a paid product where you can then apply a code.

How to Save the Most at TaxSlayer in 2025

Getting the best price on your tax software goes beyond just finding a single coupon code. By combining several smart strategies, you can ensure you're paying the absolute minimum. We've compiled every savings tactic into one comprehensive list to make you a master of TaxSlayer savings.

File for Free With Simply Free

The ultimate discount is paying nothing at all. Before anything else, check if you're eligible for the TaxSlayer Simply Free edition. It covers simple tax situations (W-2 income, standard deduction, no dependents) and includes both a federal and one state return. This should always be your first stop.

Get the Military Discount

If you are an active-duty military member, this is the best deal for you, period. TaxSlayer offers its full-featured Classic software to file your federal return for $0. It covers all complex tax situations, so you don't have to compromise on features to get the discount.

Become an Email Insider

As we've mentioned, this is the most critical step. Signing up for a free TaxSlayer account and opting into their emails puts you on the VIP list for their best and most exclusive promo codes, which are often sent directly to subscribers before they're made public.

Time Your Purchase for Early Bird Deals

TaxSlayer loves to reward filers who don't procrastinate. The best prices and promo codes of the year are often released in January when the tax season officially kicks off. By starting your return early, you can lock in these low rates.

Lock In Your Price by Starting Early

One of TaxSlayer's best-kept secrets is their price-lock feature. When you start your return, the price you see is the price you get, even if you don't finish and file until weeks later. Start your return during a sale in January, and you can come back in March to finish it while still paying the lower January price.

Watch for Seasonal and Holiday Sales

Keep an eye out during major shopping holidays. TaxSlayer has been known to offer significant discounts during Black Friday and Cyber Monday. You may also see flash sales around holidays like Presidents' Day or in the final push before the April tax deadline.

Follow TaxSlayer on Social Media

Occasionally, TaxSlayer will post special offers or announce sales on their social media channels like Facebook, Instagram, or X (formerly Twitter). It's an easy way to stay in the loop and potentially catch a deal you might otherwise miss.

Pay Your Filing Fees With Your Refund

If you'd rather not pay for your tax prep out of pocket, TaxSlayer offers the option to deduct your filing fees directly from your federal refund. While this isn't a discount, it's a convenient budgeting tool that helps you file with zero upfront cost.

Are TaxSlayer Promo Codes Worth Pursuing?

Absolutely. TaxSlayer already positions itself as one of the best values in the tax preparation market, offering robust software at a fraction of the cost of its main competitors. When you add a promo code on top of that, the deal becomes even sweeter. A 20% or 25% off coupon can turn an already affordable service into an undeniable bargain, especially for filers with more complex returns who would otherwise face steep fees elsewhere.

For a full understanding of their guarantees and policies, you can always review TaxSlayer's Terms of Service on their website.

How We Find and Publish Promo Codes

Our team of dedicated deal curators scours every corner of the internet to find the best TaxSlayer offers for you, our readers. We don't just copy and paste; we work to verify that codes are active and up-to-date, ensuring you don't waste your time with expired offers. Our goal is to provide a reliable, comprehensive resource so you can file your taxes with confidence, knowing you got the best deal possible.

Why Trust DealNews for TaxSlayer Discounts?

Our team at DealNews has been helping readers save money on everything under the sun for years, and when it comes to getting the best value on services like TaxSlayer, this year is no different. We deliver hundreds of deals to savvy shoppers every single day, covering a massive range of products—from tech gadgets and clothes to vacations and, yes, even ways to save on your tax software. All those years of experience go into making absolutely sure that every deal we publish is the best price you're likely to find.

Want to tap into that expertise directly? Consider signing up for the DealNews Select newsletter. It's your daily dose of handpicked, hot deals delivered straight to your inbox every weekday. Plus, if you're waiting for a specific price drop on tax software, you can set a deal alert and get an instant notification when a new sale begins.

Sign In or Register